Rivian Stock Price Prediction 2025 will hit $17 in 2025, average price target for RIVN is $13.80 Rivian Stock Forecast in 2025 could be well-positioned to weather the electric vehicle (EV) market downturn better than many of its competitors.

Rivian indeed had a remarkable initial public offering (IPO) in 2021, raising $11.9 billion, making it the largest IPO of the year. However, the shareholder returns have not met expectations. As for the prospects of Rivian, it’s challenging to predict the stock’s performance definitively. Rivian Automotive stock (RIVN) has received a consensus rating of buy. The average rating score is and is based on 31 buy ratings, 10 hold ratings, and 7 sell ratings.

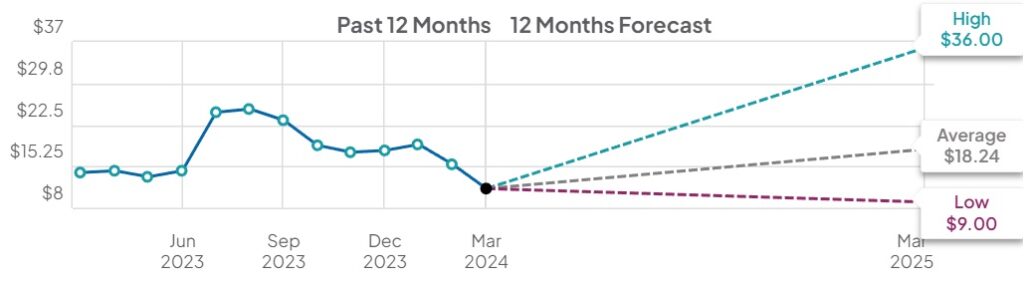

What is Rivian Stock Price Target 2025

The average price target for Rivian Automotive is $18.24, based on forecasts from 24 Wall Street analysts over the past 3 months. The highest analyst price target is $36.00, while the lowest forecast is $9.00. This average target implies a 65.22% increase from the current price of $11.04.

Why Electric Vehicle Stocks Tesla, Rivian, and Lucid Experienced Declines Today

Today saw a downturn in electric vehicle (EV) stocks, driven by disappointing first-quarter delivery reports from industry giants Tesla (TSLA -4.90%) and Rivian (RIVN -5.23%).

Tesla, a significant player in the EV market, reported a 9% decline in first-quarter deliveries, signaling ongoing challenges in demand for EVs. Rivian, often regarded as Tesla’s direct competitor in the EV space, surpassed first-quarter delivery estimates but still forecasted sluggish growth for the year.

These developments reflect broader concerns about the sustainability of demand for EVs and the perceived overvaluation of the sector. Given Tesla’s influence as an industry bellwether, news affecting the company often has a ripple effect on other EV stocks, contributing to today’s market slide.

Notably, Lucid (LCID -3.50%), another key player in the EV arena, hasn’t yet disclosed its first-quarter delivery figures. However, given its comparatively modest production and delivery numbers from the previous year, coupled with significant operating losses, the outlook for Lucid remains uncertain.

Looking ahead, the EV industry faces challenges such as the need for cost reductions in EV technology, improvements in vehicle range and charging infrastructure, and potential shifts in interest rates. Until these factors evolve significantly, it’s likely that EV stocks will continue to face difficulties throughout 2024 and beyond.

Is Rivian a good long-term stock to BUY, Sell or Hold in future?

Rivian’s (NASDAQ: RIVN) forthcoming electric SUVs have sparked significant interest among consumers and garnered positive attention from media outlets and Wall Street analysts. I anticipate this momentum to persist and grow in the near future, potentially driving up RIVN stock.

Moreover, factors such as growing optimism about the EV market overall and potential revenue enhancements from partnerships with major corporations are expected to serve as additional catalysts for RIVN’s stock performance in the medium term.

According to TipRanks.com, analysts recommend Moderate Buy Rivian (RIVN) stock, with an average 12-month price target suggesting a significant potential increase. However, there are concerns about Rivian’s finances. U.S. News suggests the company might run out of cash by 2025 because it’s losing money each month. Rivian hopes to start making more money than it spends by the end of 2024, which could be crucial for its future success, as reported by The Motley Fool. Achieving this milestone could be key for Rivian’s long-term plans, especially regarding its R2 platform.

Introduction: What is Rivian Inc?

Rivian Automotive Inc. (NASDAQ: RIVN) the USA-based electric vehicle powerhouse that stormed the NASDAQ in 2021, raising a staggering $14 billion. Led by Robert RJ Scaring and headquartered in Irvine, California, Rivian is poised for immense growth, positioned as a potential rival to Tesla Inc. Rivian’s stock price predictions and growth potential, starting from its initial stock price of $79. With a workforce of over 14,000 and a trailing 12-month revenue of $2.2 billion, Rivian emerges as a formidable contender in the dynamic electric vehicle market, challenging the industry giant with its innovative approach and substantial financial backing.

Historical Performance of Rivian Stock | EV Stocks

Rivian Automotive hit its all-time high stock closing price of $172.01 on November 16, 2021. Currently, the stock is trading significantly lower, with a 52-week high of $28.06, indicating a stark contrast of 153% from its peak. On the other hand, its 52-week low stands at $10.05, just 9.4% below its present share price.

Until early 2022, few in the investing community, especially automotive companies, anticipated discussing a slump in the EV industry a year later, with many players forced to reset their production targets due to slowing growth. Recently, Fisker (FSR), Lucid Motors (LCID), and Polestar (PSNY) have all revised down their production forecasts, while Ford and General Motors have scaled back their EV investment plans.

Even Tesla’s (TSLA) Q3 earnings call painted a bleak picture of the EV industry in the short term, with CEO Elon Musk attributing industry woes to macroeconomic slowdown and rising interest rates, signaling a cautious approach to the company’s upcoming factory in Mexico.

Rivian Stock Price Prediction

| Average Price Target | $18.24 |

| Highest Analyst Target | $36.00 |

| Lowest Analyst Forecast | $9.00 |

| Average Target Increase | 65.22% |

Rivian Stock Price Prediction According to various sources

Rivian stock price predictions vary notably. Coinpriceforecast.com forecasts a rise to $17 by the end of 2025 and $20 by 2026.

Coinpriceforecast.com

According to Rivian stock price prediction 2025 moomoo.com projects a higher price of $27.14 by the middle of 2025.

moomoo.com

However, coincodex.com offers a more conservative estimate, predicting a decrease to $8.72 by 2025, reflecting a 17.15% decline.

coincodex.com

Long Term Rivian Stock Price Prediction 2024 – 2050

According to the latest long-term forecast, Rivian’s price trajectory indicates steady growth over the coming years. In 2024 Rivian price could reach $12.02, $16.49 by the middle of 2025, $37.12 in 2029, $48.07 in 2034, $58.31 in 2040, $76.95 in 2050.

| Year | Minimum Price | Maximum Price | Average Price |

|---|---|---|---|

| 2024 | $12.02 | $29.88 | $20.95 |

| 2025 | $16.49 | $26.64 | $21.56 |

| 2029 | $27.14 | $47.09 | $37.12 |

| 2034 | $37.31 | $58.82 | $48.07 |

| 2040 | $49.84 | $66.78 | $58.31 |

| 2045 | $61.75 | $76.54 | $68.14 |

| 2050 | $68.57 | $85.33 | $76.95 |

Rivian Stock Price Prediction 2025

The Rivian stock price prediction for 2025 is currently $26.64. This forecast is based on the assumption that Rivian Automotive, Inc. shares will continue growing at the average yearly rate observed over the last 10 years. If this trend persists, it would result in a -11.15% increase in the RIVN stock price compared to the current price of $10.51.

Rivian Stock Price Prediction 2029

Rivian’s stock performance in next 5 years from now is expected to be positively influenced by the company’s continued development of electric vehicle (EV) technologies and expansion into new markets.

Based on our Rivian Stock Price Prediction 2029, a long-term increase is expected, the “RIVN” stock price prognosis for 2029 for beginning is 47.09 and dollars and $37.12 on averag and high forecast is $47.09 from its current price $10.51.

Rivian Stock Price Prediction 2030

Rivian stock price prediction for 2030 is $30.50 as the first target and $34.45 as the second target. Overall, in 2030, the Rivian stock price forecast could range from $745.34 to $845.45. After Tesla’s cyber truck, Rivian is the most popular brand in Pickup trucks (SUVs) and their designs are unique and beautiful.

Rivian Stock Price Prediction 2034

Rivian Stock Price Prediction 2034 is expect to increase by 150% from now and would reach an average price of $48.07 and RIVN stock is forecasted to range between 37.31 to 58.82 it it maintains its yearly hike rate over last 10 years from its last price of $ 10.52.

Can Rivian Make It Big in the EV Industry?

Rivian has steadily grown its market share in the U.S. electric vehicle (EV) market since the commencement of car deliveries, now ranking among the top 5 companies in terms of market share. Despite this progress, it’s essential to recognize that electric cars currently represent less than 10% of total car sales in the U.S.

While the extent of electric car market penetration by 2030 remains uncertain, even the most conservative estimates project a penetration rate exceeding 25% by the decade’s end. Consequently, for Rivian to attain a 10% market share in the U.S., it would need to significantly increase its deliveries from current levels, potentially requiring exponential growth.

Rivian currently operates a plant in Illinois with a capacity of 150,000 units, a capacity it plans to expand to 200,000 units. Additionally, the company is constructing its next plant in Georgia, initially designed to produce 200,000 vehicles. By 2030, Rivian aims to double the capacity of the Georgia plant to 400,000 units.

How to Purchase Rivian Stock in 10 Easy Steps

To BUY Rivian Stocks in Canada or any Place you just need to follow these simple steps mentioned below:

Step 1: Set up your brokerage account

Before diving into Rivian stock, ensure you have a brokerage account ready to go. While Fidelity’s $0 commission for online trades is a popular choice, there’s a myriad of alternatives out there to explore.

Step 2: Establish your financial plan

Crafting a solid investment strategy involves thoughtful budgeting. Consider whether you prefer gradually building your position over time or making a substantial single investment. Whatever you decide, pick an amount that won’t keep you up at night if the stock takes a dip.

Step 3: Conduct thorough research

Now it’s time to roll up your sleeves and delve into Rivian’s potential. Assess the company’s financial health, scrutinize its strengths, weaknesses, opportunities, and threats (SWOT), and evaluate its current valuation.

Step 4: Execute your trade

Having completed your analysis, if you’re confident in your findings, go ahead and click that buy button to become a proud Rivian shareholder.

Is Rivian a sound investment?

Investors have a plethora of reasons to consider adding Rivian to their portfolio. Firstly, it provides exposure to the thriving EV industry with Rivian standing as a notable player. Renowned publications like Car and Driver and Consumer Reports rave about Rivian’s R1T, labeling it as one of the most capable and cutting-edge electric pickups on the market.

Disclaimer:

It’s essential to consider unforeseen events, market changes, and competitive pressures that can influence stock prices in the long term. Investors should exercise prudence and conduct thorough research before making investment decisions.

-

Are Rivian Shares a good buy for the long term?

Investing in Rivian shares long-term is contingent on the company’s performance and ability to achieve its goals. Presently, Rivian is making strides toward success.

-

How much time will Rivian Stock take to recover?

The recovery of Rivian stock price is anticipated to happen soon if the company improves its supply chain management process.

-

Will Rivian Stock rise today?

Based on CNN’s predictions, Rivian stock may experience an upward movement. However, thorough research is crucial before making any investment decision.

-

Should I invest in rivian Stock?

Deciding to invest in Rivian stock depends on your risk tolerance and investment horizon. Competition from rivals like Tesla and Ford in the rapidly expanding market could influence Rivian’s stock prices.

-

What is the RIVN average 12-month price target?

Rivian 12-month (NASDAQ: RIVN) median price target of $27.30, with a high estimate of $42.00 and a low estimate of $14.70. The median estimate represents a +2.99% increase from the last price of 25.27.

-

What is RIVN’s upside potential, by analysts’ average price target?

Rivian Automotive has 107% upside potential, following analysts’ average price target

-

Where to buy Rivian stock?

To purchase Rivian stock, you can register with reputable exchange brokers like E*Trade and Webull. The Stock is listed in NASDAQ under Symbol RIVN.

-

What is the ticker code of Rivian Inc?

Rivian Inc.’s ticker code is RIVN as on NASDAQ.

-

Why is Rivian Stock Price low these days?

The stock price of Rivian is low since the company is not making a profit & also because of inadequate supply chain management, the company is experiencing certain problems. Due to improper management, Rivian’s electric adventure vehicles are not making a profit, which reduces sales.

-

What is the total volume of Rivian Stock in 2023?

The total volume of Rivian Stock in 2023 is 2,327,833

-

Will Rivian stock survive?

Rivian has a strong likelihood of survival due to its position as an electric vehicle (EV) manufacturer that has garnered significant attention and funding in the rapidly growing EV industry.

-

Where will Rivian stock be in five years?

Experts predict that in five years, Rivian stock may have an average price of $48, with the minimum and maximum stock prices around $37 and $58, respectively.

-

How High Will Rivian Stock Go?

According to our RIVN stock forecast, Rivian has the potential to provide favorable returns to mid-term and long-term investors. The projected values indicate that Rivian could be worth $70 in 2025, $95 in 2027, and $125 in 2030.

-

What will be the future of Rivian stock?

Rivian, as a prominent EV manufacturer, stands out in the industry compared to other smaller EV makers. Its stock presents an attractive option for long-term investors with the potential for good returns, as indicated by Marketwatch.com.

-

What is the rivian stock price prediction for 2025?

In 2025, the RIVN stock price is expected to reach an average price value of $37.15.