Top 10 Crypto Trading Bots: Cryptocurrency trading bots are becoming increasingly popular among traders as a way to automate trades in the dynamic crypto market. With so many bots available, it can be difficult to determine which one best suits your needs. In this article, we will review and compare the top 10 crypto trading bots for 2023, so you can make an informed decision. Understanding Best Trading Bots: How They Can Benefit Traders in the Cryptocurrency Market.

Automated crypto trading bots use pre-set algorithms to analyze market data and execute trades automatically. Learn how these bots work, their types, and the benefits they offer to traders in the volatile cryptocurrency market.

Cryptocurrency trading can be a daunting task for beginners and seasoned traders alike. The cryptocurrency market is highly volatile, with prices fluctuating rapidly, making it difficult to keep up with market trends and execute trades at the right time. This is where crypto trading bots come in. In this article, we will provide an in-depth understanding of crypto trading bots and how they can benefit traders in the cryptocurrency market.(Top 10 Crypto Trading Bots)

Don’t Miss to Read – Price Prediction

What are Crypto Trading Bots?

Crypto trading bots are software programs that use pre-set algorithms to automate trading strategies in the cryptocurrency market. These bots analyze market data, such as price trends, volume, and other indicators, to determine the optimal time to buy or sell a particular cryptocurrency. The bots can execute trades automatically based on the trader’s preferred trading strategies, eliminating the need for manual trading.

How Do Crypto Trading Bots Work?

Crypto trading bots use pre-set algorithms to analyze market data and execute trades based on the trader’s chosen trading strategy. The algorithms use technical analysis tools, such as moving averages and chart patterns, to identify market trends and make trading decisions. The bots can also set stop-loss and take-profit orders to minimize potential losses or secure profits.(Top 10 Crypto Trading Bots)

Types of Crypto Trading Bots.

There are several types of crypto trading bots, each with its unique features and strategies. These include:

- Trend Trading Bots: These bots analyze market trends and make trades based on the direction of the trend.

- Arbitrage Trading Bots: These bots identify price discrepancies between different cryptocurrency exchanges and make trades to take advantage of these discrepancies.

- Market-Making Bots: These bots provide liquidity to the market by placing buy and sell orders on both sides of the market.

- Scalping Bots: These bots make small profits on multiple trades by taking advantage of short-term price movements.

Benefits of Crypto Trading Bots

Crypto trading bots offer several benefits to traders, including:

Automation: Crypto trading bots automate trading strategies, saving traders time and effort.

Market Analysis: Bots can analyze market data more quickly and accurately than humans, identifying trading opportunities that may have been missed.

24/7 Trading: Crypto trading bots can execute trades around the clock, even when the trader is sleeping or not actively monitoring the market.

Emotional Discipline: Bots can remove emotions from trading, preventing traders from making impulsive decisions based on fear or greed.

Read More: Bitcoin vs Ethereum | Litecoin

3Commas

3Commas is a cloud-based trading platform with a user-friendly interface, offering features like automated trading, social trading, and trailing stop loss. It supports multiple exchanges like Binance, Bitfinex, and Coinbase, making it ideal for traders of all levels. With pricing plans starting at $29 per month, 3Commas is a budget-friendly option.

Features and Advantages of 3Commas

Automated Trading

3Commas provides an automated trading system that allows users to create custom trading bots that can execute trades based on predetermined rules. This means that traders can create their own trading strategies and set up their bots to execute trades based on these rules automatically.

Advanced Order Types

3Commas offers advanced order types such as stop-loss, take-profit, and trailing stop-loss orders that can help traders manage their portfolios effectively. These orders are designed to help traders minimize losses and lock in profits.

Portfolio Management

The platform provides portfolio management tools that allow traders to monitor their portfolio’s performance, including the ability to track profits and losses, view the allocation of assets, and view the value of their portfolio in real time.

Trading Signals

3Commas provides trading signals that enable traders to receive alerts when a particular asset reaches a certain price level or when a specific technical indicator is triggered. This feature allows traders to respond quickly to market changes and make informed trading decisions.

Risk Management

3Commas provides tools to help traders manage their risk effectively, including the ability to set stop-loss orders and the option to use the platform’s trailing stop-loss feature to protect profits.

Integrations

3Commas integrates with major cryptocurrency exchanges such as Binance, Bitfinex, and Coinbase Pro, enabling traders to access multiple exchanges from a single platform. This integration ensures that traders can execute trades quickly and efficiently.

How to Use 3Commas

Create an Account

The first step to using 3Commas is to create an account on the platform. This process is simple and requires users to provide basic personal information such as their name and email address.

Connect to an Exchange

After creating an account, users can connect their 3Commas account to a cryptocurrency exchange such as Binance or Coinbase Pro. This connection allows users to execute trades and manage their portfolios from a single platform.

Create a Trading Bot

Once connected to an exchange, users can create a trading bot by specifying their trading strategy, including the assets to trade, the order types to use, and the conditions that trigger the bot to execute trades.

Monitor Your Portfolio

After creating a trading bot, users can monitor their portfolio’s performance and adjust their trading strategy as needed. The platform provides real-time data on the value of the portfolio, the allocation of assets, and the performance of the trading bot.

Conclusion

3Commas is a powerful cryptocurrency trading bot that provides a range of features and benefits for traders. Its automated trading system, advanced order types, and risk management tools make it an excellent choice for traders looking to optimize their cryptocurrency trading strategies. With its integrations with major cryptocurrency exchanges and its user-friendly interface, 3Commas is an excellent tool for both novice and experienced traders. (Top 10 Crypto Trading Bots)

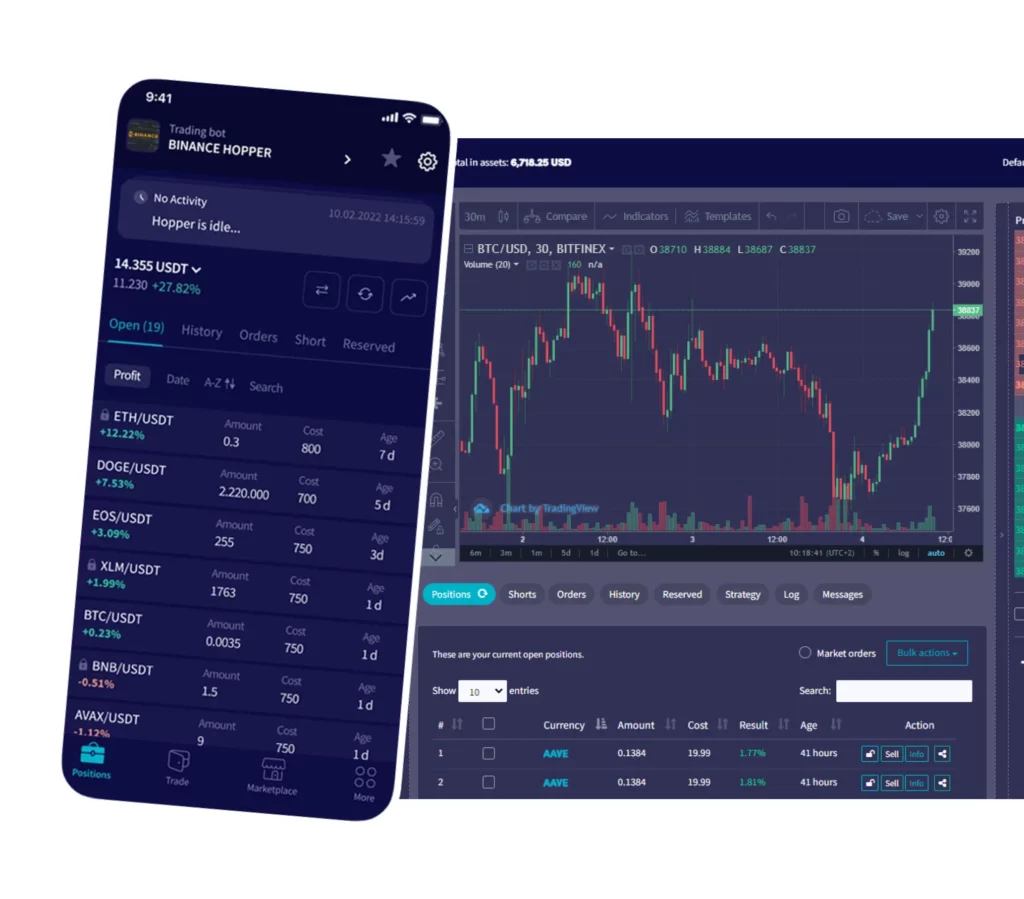

Cryptohopper

Cryptohopper is a popular trading bot that offers features like backtesting, technical analysis, and automatic trading. It supports multiple exchanges like Binance, Coinbase, and Kraken. With an intuitive dashboard and user-friendly interface, it’s suitable for both novice and experienced traders. Pricing plans for Cryptohopper start at $19 per month.

Features and Benefits of Cryptohopper

Automated Trading Cryptohopper provides an automated trading system that allows users to create custom trading bots that can execute trades based on predetermined rules. This means that traders can create their own trading strategies and set up their bots to execute trades based on these rules automatically. (Top 10 Crypto Trading Bots)

Advanced Order Types Cryptohopper offers advanced order types such as stop-loss, take-profit, and trailing stop-loss orders that can help traders manage their portfolios effectively. These orders are designed to help traders minimize losses and lock in profits.

Technical Analysis Tools The platform provides a range of technical analysis tools, including candlestick charts, trend analysis, and other indicators that can help traders identify trends and make informed trading decisions.

Social Trading Cryptohopper offers a social trading feature that enables users to follow and copy the trades of successful traders on the platform. This feature allows traders to learn from experienced traders and improve their own trading strategies.

Backtesting The platform provides a backtesting feature that enables users to test their trading strategies using historical data to determine their effectiveness. This feature allows traders to fine-tune their strategies and optimize their trading performance.

Risk Management Cryptohopper provides tools to help traders manage their risk effectively, including the ability to set stop-loss orders and the option to use the platform’s trailing stop-loss feature to protect profits.

Integrations Cryptohopper integrates with major cryptocurrency exchanges such as Binance, Kraken, and Coinbase Pro, enabling traders to access multiple exchanges from a single platform. This integration ensures that traders can execute trades quickly and efficiently.

How to Use Cryptohopper

Create an Account The first step to using Cryptohopper is to create an account on the platform. This process is simple and requires users to provide basic personal information such as their name and email address.

Connect to an Exchange After creating an account, users can connect their Cryptohopper account to a cryptocurrency exchange such as Binance or Kraken. This connection allows users to execute trades and manage their portfolios from a single platform.

Create a Trading Bot Once connected to an exchange, users can create a trading bot by specifying their trading strategy, including the assets to trade, the order types to use, and the conditions that trigger the bot to execute trades. This process is straightforward and can be completed in a few simple steps.

Monitor Your Portfolio After creating a trading bot, users can monitor their portfolio’s performance and adjust their trading strategy as needed. The platform provides real-time data on the value of the portfolio, the allocation of assets, and the performance of the trading bot.

Conclusion

Cryptohopper is a powerful cryptocurrency trading bot that provides a range of features and benefits for traders. Its automated trading system, advanced order types, and risk management tools make it an excellent choice for traders looking to optimize their cryptocurrency trading strategies. With its integrations with major cryptocurrency exchanges and its user-friendly interface, Cryptohopper is an excellent tool for both novice and experienced traders. By utilizing the various features and tools available on the platform, traders can improve their trading performance and achieve greater success in the cryptocurrency market. (Top 10 Crypto Trading Bots)

HaasOnline

HaasOnline is a trading bot designed for experienced traders, offering advanced features like margin trading, backtesting, and technical analysis. It supports multiple exchanges like Binance, Bitfinex, and Bitstamp. Although HaasOnline is a bit pricey with pricing plans starting at $99 per month, it’s a powerful tool for advanced traders.

Features & Advantages of HaasOnline Trading Bot

Customizable Strategies HaasOnline offers a wide range of customizable trading strategies that traders can use to execute their trades. These strategies can be customized based on different market conditions, trading pairs, and technical indicators.

Market Making HaasOnline provides market-making tools that allow traders to place limit orders above and below the market price, providing liquidity to the market and earning profits from the spread.

Arbitrage Trading HaasOnline offers arbitrage trading tools that enable traders to take advantage of price differences between different cryptocurrency exchanges. This feature is particularly useful in markets with low liquidity, where prices can differ significantly between exchanges.

Scalping HaasOnline offers scalping tools that allow traders to execute high-frequency trades, taking advantage of small price movements to earn profits. This feature is ideal for traders who prefer short-term trading strategies.

How to Use HaasOnline Trading Bot

Create an Account The first step to using the HaasOnline trading bot is to create an account on the platform. This process is simple and requires users to provide basic personal information.

Connect to an Exchange After creating an account, users can connect their HaasOnline account to a cryptocurrency exchange. HaasOnline supports multiple exchanges, including Binance, Bitfinex, and Coinbase Pro.

Customize Your Trading Strategies Once connected to an exchange, users can customize their trading strategies based on their preferences, trading pairs, and technical indicators. HaasOnline provides a range of customizable strategies that can be used for different market conditions and trading pairs.

Monitor Your Trades After customizing your trading strategies, you can monitor your trades’ performance using HaasOnline’s real-time reporting and monitoring tools. These tools provide traders with a detailed view of their trades’ performance, allowing them to adjust their strategies accordingly.

Conclusion

A haasOnline trading bot is a powerful tool that can help traders execute their crypto trading strategies more efficiently. Its advanced features, including customizable trading strategies, market analysis tools, and risk management features, make it an excellent choice for both novice and experienced traders. With its easy-to-use interface and support for multiple exchanges, the HaasOnline trading bot is a must-have tool for any serious cryptocurrency trader.(Top 10 Crypto Trading Bots)

Gunbot

Gunbot is another trading bot designed for experienced traders, offering features like technical analysis, backtesting, and automatic trading. It supports multiple exchanges like Binance, Bitfinex, and Coinbase. With advanced features like trailing stop loss and margin trading, it’s a great tool for experienced traders who want more control over their trades. Pricing plans for Gunbot start at a one-time payment of $129.

Features and Advantages of Gunbot

Customizable Trading Strategies Gunbot offers a range of customizable trading strategies that enable traders to define their own parameters for buying and selling cryptocurrencies. The bot can be configured to use different technical analysis indicators such as Bollinger Bands, Moving Average, and RSI to identify profitable trades.

Automated Trading Gunbot allows traders to automate their trading strategy and execute trades based on predefined rules. Once you’ve set up your trading strategy, Gunbot will monitor the market and execute trades automatically, saving you time and effort.

Multiple Trading Strategies Gunbot offers multiple trading strategies, including Spot Trading, Margin Trading, and Futures Trading. The bot supports both short-term and long-term trading, enabling traders to choose the strategy that best fits their trading goals.

Technical Analysis Indicators Gunbot comes equipped with a range of technical analysis indicators, enabling traders to make informed trading decisions based on market trends. Some of the most popular indicators include Bollinger Bands, Moving Average, and RSI.

Risk Management Gunbot provides traders with risk management tools such as stop-loss orders, which automatically close positions if the price of an asset falls below a specified level. The bot also provides a trailing stop-loss feature, which adjusts the stop-loss level based on the current price of the asset.

Backtesting Gunbot enables traders to backtest their trading strategies, allowing them to analyze the performance of their strategy in historical market conditions. This feature is particularly useful for traders who want to optimize their strategies and identify potential areas for improvement.

How to Use Gunbot

Setting up Gunbot is a straightforward process that involves the following steps:

- Purchase a Gunbot License: Choose a plan that suits your needs and purchase a license on the official Gunbot website.

- Choose an Exchange: Gunbot supports multiple exchanges, so choose the exchange where you want to trade.

- Set up Your Trading Strategy: Configure your trading strategy by selecting the appropriate technical analysis indicators and defining your buying and selling parameters.

- Monitor Your Trades: Monitor your trades and adjust your strategy as needed.

Conclusion

Gunbot is a powerful trading bot that offers a range of features and benefits for cryptocurrency traders. Its customizable trading strategies, automated trading, risk management tools, and technical analysis indicators make it an excellent choice for traders looking to optimize their trading strategies. With its support for multiple exchanges and user-friendly interface, Gunbot is an excellent tool for both novice and experienced traders. By automating your trading strategy with Gunbot, you can save time and effort while increasing your chances of making profitable trades in the volatile world of cryptocurrency trading. (Top 10 Crypto Trading Bots)

Zenbot

Zenbot is an open-source trading bot that supports multiple exchanges like Binance, Bitfinex, and Coinbase. It’s designed for advanced traders, offering features like automated trading, backtesting, and technical analysis. With advanced features like custom indicators and multiple asset support, Zenbot is a powerful tool, and the best part is that it’s free to use.

Features & Advantages of Zenbot Trading Bot

Zenbot Zenbot has several features that make it a top choice among traders:

- Customizable strategies: Zenbot allows users to create and test their own trading strategies using JavaScript code or use pre-built strategies.

- Backtesting: The platform provides a backtesting tool that enables users to test their strategies against historical data.

- Real-time monitoring: Zenbot allows users to monitor their portfolio performance in real time and receive alerts when a trade is executed.

- Multiple exchanges: Zenbot supports trading on several cryptocurrency exchanges, including Binance, Bitfinex, and Kraken.

- Technical analysis: The platform provides several technical analysis tools, including candlestick charts and moving averages, to help users make informed trading decisions.

How to Use Zenbot

Here’s how to use Zenbot to start trading cryptocurrencies:

- Install Zenbot: Zenbot can be installed on any operating system, including Windows, macOS, and Linux.

- Set up an exchange account: To use Zenbot, you’ll need to set up an account with a supported exchange and obtain an API key.

- Create or choose a strategy: You can create your own trading strategy using JavaScript code or use a pre-built one. Zenbot provides several pre-built strategies, including EMA and MACD.

- Configure your bot: Once you’ve selected a strategy, you can configure your bot by setting parameters such as trade size, stop loss, and take profit.

- Monitor your portfolio: Zenbot provides real-time monitoring of your portfolio’s performance, allowing you to adjust your trading strategy as needed.

Conclusion (Top 10 Crypto Trading Bots)

Zenbot is an excellent trading bot platform for anyone looking to automate their cryptocurrency trading strategies. With its customizable strategies, backtesting tool, and real-time monitoring, Zenbot provides everything you need to trade cryptocurrencies with ease. By following the steps outlined in this guide, you’ll be well on your way to becoming a successful automated trader in (Top 10 Crypto Trading Bots)

Margin.de Trading Bot

Margin.de is a trading bot designed for experienced traders, offering features like backtesting, technical analysis, and automatic trading. It supports multiple exchanges like Binance, Bitfinex, and Coinbase. With advanced features like margin trading and short selling, Margin.de is a powerful tool for experienced traders. Pricing plans for Margin.de start at $25 per month.

Features and benefits of Margin.de

advantages of using Margin.de: (Top 10 Crypto Trading Bots)

- Automated Trading One of the biggest advantages of using Margin.de is the ability to automate your trading strategies. The platform offers a range of trading bots that can be customized to meet your specific trading needs. These bots can execute trades automatically based on pre-set parameters, freeing up your time to focus on other tasks.

- Backtesting Margin.de allows users to backtest their trading strategies using historical data from the cryptocurrency market. This feature is particularly useful for traders who want to evaluate the effectiveness of their strategies before using them in live trading. By backtesting your strategy, you can identify weaknesses and make adjustments before risking real capital.

- Portfolio Management Margin.de provides users with a comprehensive portfolio management tool that allows them to track their holdings across multiple exchanges. The platform provides real-time data on the value of your portfolio, the allocation of assets, and the performance of your trading bots. This feature makes it easy to monitor your investments and make informed trading decisions.

- Customizable Notifications Margin.de offers customizable notifications that alert users to important events in the cryptocurrency market. These notifications can be configured to alert users to price changes, order fills, and other trading-related events. This feature ensures that traders are always up-to-date on market developments and can take action accordingly.

- Multiple Exchanges Margin.de supports multiple exchanges, including Binance, Bitfinex, BitMEX, Kraken, and more. This means that traders can use the platform to execute trades on their preferred exchange, without having to switch between different platforms.

- Security Margin.de takes security seriously and implements several measures to protect user funds. The platform uses two-factor authentication (2FA) to secure user accounts, and all sensitive information is encrypted using industry-standard encryption algorithms.

Conclusion (Top 10 Crypto Trading Bots)

Margin.de is a powerful trading bot platform that offers a range of advantages for cryptocurrency traders. From automated trading to backtesting, portfolio management, customizable notifications, and support for multiple exchanges, Margin.de has everything a trader needs to succeed in the cryptocurrency market. So, if you’re looking for a reliable and efficient trading bot platform, Margin.de is definitely worth considering.(Top 10 Crypto Trading Bots)

How to use Margin.de Trading Bot

Step 1: Create an Account

The first step to using Margin.de is to create an account on the platform. This process is simple and requires users to provide basic personal information such as their name and email address. Once you’ve created an account, you’ll need to connect your Margin.de account to a cryptocurrency exchange. Margin.de currently supports connections to Binance, Bitfinex, BitMEX, Deribit, and Kraken.

Step 2: Choose a Trading Bot

Margin.de offers a range of trading bots that can be used to automate your trading strategies. These bots are designed to work on specific exchanges and can be customized to meet your trading needs. Some of the most popular trading bots include the Grid Bot, DCA Bot, and TWAP Bot.

Step 3: Configure Your Trading Bot

Once you’ve chosen a trading bot, you’ll need to configure it to execute trades based on your specific trading strategy. This process involves setting parameters such as buy and sell price levels, order size and stop loss limits. Margin.de provides a range of customization options, allowing you to fine-tune your trading bot to meet your needs.

Step 4: Backtest Your Trading Strategy

Before using your trading bot in live trading, it’s important to backtest your trading strategy using historical data from the cryptocurrency market. This allows you to evaluate the effectiveness of your strategy and make any necessary adjustments. Margin.de provides a user-friendly backtesting tool that makes it easy to test your trading strategy using historical data.

Step 5: Monitor Your Portfolio

After configuring your trading bot, you can monitor your portfolio’s performance and adjust your trading strategy as needed. Margin.de provides real-time data on the value of your portfolio, the allocation of assets, and the performance of your trading bot. You can also set customizable notifications that alert you to important events in the cryptocurrency market.

Conclusion

Margin.de is a powerful trading bot platform that offers a range of features designed to help cryptocurrency traders automate their trading strategies. Whether you’re a novice or an experienced trader, Margin.de can help you take advantage of the volatility in the cryptocurrency market. By following the steps outlined in this article, you can start using Margin.de to automate your cryptocurrency trading and maximize your profits.(Top 10 Crypto Trading Bots)

Kryll Trading Bot

Kryll is a cloud-based trading platform that supports multiple exchanges like Binance, Bitfinex, and Coinbase. It offers features like backtesting, technical analysis, and automatic trading. With pricing plans starting at $19 per month, Kryll is a budget-friendly option for traders of all levels.

Key Features of Kryll Trading Bot

Strategy Editor: Kryll offers a user-friendly strategy editor that allows traders to create and customize their trading bots. The editor provides a wide range of technical indicators and trading signals that can be used to create complex trading strategies.

- Backtesting: Kryll allows traders to test their trading bots using historical data to evaluate the performance of their strategies before deploying them in live trading.

- Marketplace: Kryll has a marketplace where traders can buy and sell trading strategies. This feature allows traders to monetize their strategies and earn passive income.

- Mobile App: Kryll has a mobile app that allows traders to monitor and manage their trading bots on the go.

- Security: Kryll uses two-factor authentication and SSL encryption to secure user accounts and transactions.

How to Use Kryll Trading Bot?

- Create an Account: To use the Kryll trading bot, traders must first create an account on the platform. The registration process is simple and requires basic personal information such as name and email address.

- Connect to an Exchange: After creating an account, traders can connect their Kryll account to a supported cryptocurrency exchange. Kryll supports popular exchanges such as Binance, Bitfinex, and Kraken.

- Create a Strategy: Once connected to an exchange, traders can create their trading strategy using the strategy editor. Traders can choose from a wide range of technical indicators and trading signals to create their strategy.

- Backtest Your Strategy: After creating a strategy, traders can backtest it using historical data to evaluate its performance.

- Deploy Your Strategy: Once a strategy has been backtested and optimized, traders can deploy it in live trading. Traders can monitor the performance of their trading bot and make adjustments as needed.

Conclusion

Kryll trading bot is an automated solution for cryptocurrency traders that provides a user-friendly interface for creating and deploying trading strategies. With a wide range of technical indicators and trading signals, traders can create complex trading strategies without the need for programming skills. The platform’s backtesting feature allows traders to evaluate the performance of their strategies before deploying them in live trading. Kryll’s marketplace feature also allows traders to monetize their strategies and earn passive income. With its focus on security and ease of use, the Kryll trading bot is a valuable tool for traders looking to automate their trading strategies. (Top 10 Crypto Trading Bots)

Pionex Trading Bot

Pionex is a powerful and intuitive all-in-one crypto trading bot that has been gaining popularity in the cryptocurrency community. Whether you’re a novice or an experienced trader, Pionex offers a range of unique features and customization options to help you maximize your profits.

Features & Advantages of Pionex Trading Bot.

Pionex stands out from other crypto trading bots with its impressive range of features, including:

- Grid Trading: Pionex’s Grid Trading feature allows users to buy and sell assets within a predefined price range, even in sideways markets. The bot automatically buys low and sells high, generating profits for the user.

- Dollar-Cost Averaging (DCA): Pionex’s DCA feature is a risk management tool that enables users to automatically purchase assets at set intervals, reducing the risk of price fluctuations and minimizing losses.

- Copy Trading: Pionex’s Copy Trading feature allows novice traders to copy the trades of experienced traders on the platform, eliminating the need for manual trading.

- Trading Bots: Pionex offers a variety of trading bots, each with its own unique features and strategies. Users can customize their trading approach and maximize their potential profits.

- Leveraged Trading: Pionex’s leveraged trading feature allows users to trade with leverage, increasing their potential profits but also their risks.

Advantages: Pionex has several advantages over other trading bots, including: (Top 10 Crypto Trading Bots)

- User-friendly Interface: Pionex’s intuitive interface makes it easy for novice traders to learn how to use the platform and start trading.

- Low Fees: Pionex charges a 0.05% trading fee per transaction, which is lower than many other trading bots. Users can also earn rewards for holding PION, the platform’s native token.

- Security: Pionex takes security seriously and offers 2-factor authentication, IP blocking, and withdrawal whitelists to protect users’ funds.

How to use the Pionex trading bot

Create an Account The first step is to create an account on Pionex. This process is easy, and users need to provide their basic personal information, such as name and email address.

Connect to an Exchange After creating an account, connect your Pionex account to a supported cryptocurrency exchange, such as Binance or Huobi. This connection enables users to execute trades and manage their portfolios from a single platform.

Select a Trading Bot Pionex offers a wide range of pre-built trading bots that users can choose from, depending on their preferred trading strategies. Users can also create custom bots that are tailored to their specific needs.

Configure Your Trading Bot Once a trading bot has been selected, configure it to execute trades based on specific trading strategies. This process involves setting parameters such as buy and sell price levels, order size, and stop loss limits. Users can also test their strategies using the platform’s backtesting feature.

Monitor Your Portfolio After configuring the trading bot, monitor your portfolio’s performance in real-time using the platform’s user-friendly interface. You can view the value of your portfolio, the allocation of assets, and the trading bot’s performance. Users can also adjust their trading strategies as needed.

Conclusion: Pionex is a versatile and user-friendly crypto trading bot that offers a range of unique features and advantages for traders. Its grid trading and DCA features are especially popular for risk management, while its copy trading and trading bots are great for novice traders. With low fees and robust security measures, Pionex is a reliable and solid option for anyone looking to start trading in the cryptocurrency market. So why not give Pionex a try and see how it can help you maximize your profits in 2023? (Top 10 Crypto Trading Bots)

TradeSanta Trading Bot

TradeSanta is a cloud-based cryptocurrency trading bot that automates the process of buying and selling digital currencies. It was launched in 2018 and has since become a popular tool for traders looking to take advantage of the volatility of the cryptocurrency market. In this article, we will take a closer look at TradeSanta and explore its features and benefits.

Features & Advantages of Tradesanta Trading Bot

Features of TradeSanta

TradeSanta is a cloud-based platform that allows users to set up custom trading bots that execute trades automatically. The platform supports several popular exchanges, including Binance, Bitfinex, Bittrex, HitBTC, and Huobi, making it easy for users to trade on their preferred exchange.

Another important feature of TradeSanta is its technical analysis tools. The platform provides users with a range of technical indicators, including moving averages, MACD, and RSI, to inform trading decisions. Users can also set up custom signals based on these indicators, which can trigger buy and sell orders.

TradeSanta also supports various trading strategies, including long and short strategies, that traders can use to take advantage of market trends. The platform also allows users to set up stop-loss and take-profit orders, which can help to minimize risk and maximize profits. (Top 10 Crypto Trading Bots)

Benefits of TradeSanta

One of the main benefits of TradeSanta is its automation. The platform automates the trading process, allowing users to take advantage of market opportunities even when they are not actively monitoring the market. The bot is also designed to execute trades quickly and efficiently, reducing the impact of market volatility.

Another benefit of TradeSanta is its technical analysis tools. The platform’s indicators can help users to identify market trends and make more informed trading decisions.

TradeSanta also provides users with a range of educational materials and customer support. The platform is designed to be user-friendly, and the support team is available to help users with any questions or issues they may have.

How to Use TradeSanta Trading Bot

Learn how to use the TradeSanta trading bot to automate your trading strategy and maximize your profits. Follow this step-by-step guide to set up your trading bot and choose the best trading strategy for your goals.

Step 1: Create and Verify Your TradeSanta Account

Before using the TradeSanta trading bot, create and verify your TradeSanta account by providing personal information and uploading a valid ID card or passport. Once verified, fund your account with your preferred currency.

Step 2: Connect Your Account to TradeSanta Trading Bot

Connect your TradeSanta account to the TradeSanta trading bot platform by signing up for an account on the bot’s website. Once completed, connect your TradeSanta account to the platform.

Step 3: Choose Your Trading Strategy (Top 10 Crypto Trading Bots)

Choose from long and short strategies, as well as those based on technical indicators like moving averages, MACD, and RSI. Select the strategy that best fits your trading style and investment goals.

Step 4: Set Up Your Trading Bot

Set up your trading bot by configuring your trading parameters, such as trade size and frequency, as well as stop-loss and take-profit orders to minimize risk and maximize profits.

Step 5: Monitor Your Trading Bot (Top 10 Crypto Trading Bots)

Monitor your TradeSanta trading bot to ensure it’s performing as expected. Check your trading activity and performance metrics by logging in to your TradeSanta trading bot account.

Conclusion

TradeSanta is a powerful trading bot that can help traders to take advantage of the volatility of the cryptocurrency market. Its user-friendly interface, technical analysis tools, and support for multiple exchanges make it a popular choice among traders of all skill levels. While no trading bot can guarantee profits, TradeSanta’s automation and analysis features can help traders to make more informed decisions and reduce their risk. If you are looking for a trading bot to help you make profits in the cryptocurrency market, TradeSanta is worth considering.(Top 10 Crypto Trading Bots)

Etoro Trading Bot

In this article, we will take a closer look at the eToro trading bot and its features. While this can be an effective way to make profits, some users prefer to take a more hands-off approach to trade. This is where trading bots come in. eToro trading bot can automate the trading process, allowing users to execute trades automatically.

Features of eToro Trading Bot

eToro trading bot is a cloud-based platform that allows users to automate their trading strategies by setting up custom trading bots that execute trades automatically. The platform supports several popular exchanges, including eToro, making it easy for users to trade on their preferred exchange.

One of the key features of the eToro trading bot is its ability to perform technical analysis. The platform provides users with a range of technical indicators, including moving averages, MACD, and RSI, that can be used to inform trading decisions. The bot also allows users to set up custom signals based on these indicators, which can be used to trigger buy and sell orders.

eToro trading bot also supports various trading strategies, including long and short strategies, which can be used to take advantage of market trends. Users can also set up stop-loss and take-profit orders, which are designed to minimize risk and maximize profits. (Top 10 Crypto Trading Bots)

Benefits of eToro Trading Bot

One of the main benefits of the eToro trading bot is its automation. The platform automates the trading process, allowing users to take advantage of market opportunities even when they are not actively monitoring the market. The bot is also designed to execute trades quickly and efficiently, reducing the impact of market volatility.

Another benefit of the eToro trading bot is its ability to perform technical analysis. The platform’s indicators can help users to identify market trends and make more informed trading decisions.

eToro trading bot also provides users with a range of educational materials and customer support. The platform is designed to be user-friendly, and the support team is available to help users with any questions or issues they may have.

How To Use Etoro Trading Bot

Create and Verify Your eToro Account

To start using the eToro trading bot, create and verify your eToro account. This involves providing your personal information and verifying your identity by uploading a valid ID card or passport. Once your account is verified, you can fund it with your preferred currency.

Step 2: Connect Your Account to eToro Trading Bot

Connect your eToro account to the bot’s platform to start using the eToro trading bot. Simply log in to your eToro account, navigate to the eToro trading bot website, and sign up for an account. Once you’ve done this, you can connect your eToro account to the platform. (Top 10 Crypto Trading Bots)

Step 3: Choose Your Trading Strategy (Top 10 Crypto Trading Bots)

eToro trading bot offers several trading strategies that you can use to automate your trading. These include long and short strategies, as well as strategies based on technical indicators such as moving averages, MACD, and RSI. Choose the strategy that suits your trading style and investment goals.

Step 4: Set Up Your Trading Bot

After choosing your trading strategy, set up your trading bot. This involves setting your trading parameters, such as the size of your trades and the frequency of your trading activity. You can also set up stop-loss and take-profit orders to minimize your risk and maximize your profits.

Step 5: Monitor Your Trading Bot (Top 10 Crypto Trading Bots)

Although the eToro trading bot is designed to be hands-off, it’s important to monitor your bot to ensure that it’s performing as expected. You can do this by logging in to your eToro trading bot account and checking your trading activity and performance metrics.

Conclusion (Top 10 Crypto Trading Bots)

In conclusion, the eToro trading bot is a powerful trading tool that can help investors to automate their trading strategies and take advantage of market opportunities even when they are not actively monitoring the market. Its automation, technical analysis tools, and support for multiple exchanges make it a popular choice among traders of all skill levels. While no trading bot can guarantee profits, the eToro trading bot’s automation and analysis features can help investors to make more informed decisions and reduce their risk. If you are looking for a hands-off approach to profitable trading, the eToro trading bot is definitely worth considering.

Disadvantages of Trading Bots

Trading bots are a popular way to automate trading strategies, but they come with potential risks. This article explores the drawbacks of trading bots and how to mitigate them.

Introduction: (Top 10 Crypto Trading Bots)

Trading bots have become a go-to tool for traders looking to automate their trading strategies and increase their profitability. However, while trading bots offer many benefits, they also come with potential risks and drawbacks. In this article, we’ll explore the disadvantages of trading bots and how to mitigate their risks.

- Technical Issues: (Top 10 Crypto Trading Bots)

One of the significant disadvantages of trading bots is technical issues. Trading bots are software programs that rely on technology to function properly. However, technical issues such as software bugs, connection failures, and system crashes can occur, resulting in potential losses. To mitigate this risk, it’s crucial to have a backup plan in place and ensure that the trading bot is regularly maintained and updated.

- Market Volatility: (Top 10 Crypto Trading Bots)

Another disadvantage of trading bots is their inability to predict sudden market changes caused by unexpected news or events. Trading bots operate based on pre-set algorithms, and sudden market volatility can cause them to make unprofitable trades or miss opportunities. Therefore, it’s essential to keep an eye on market news and events to mitigate this risk.

- Lack of Human Touch: (Top 10 Crypto Trading Bots)

Trading bots lack human intuition, which can be a disadvantage in a rapidly changing market. Experienced traders often make trading decisions based on market sentiment, current events, and other factors that trading bots cannot account for. While trading bots can assist in executing trades, it’s important to have a human element in the decision-making process.

- Overreliance on Automation: (Top 10 Crypto Trading Bots)

Traders may become over-reliant on trading bots and fail to monitor their trades regularly. This can lead to missed opportunities or losses that could have been prevented by human intervention. It’s important to remember that trading bots are tools to help with trading, not a substitute for human decision-making. Traders should regularly review their trading strategies and adjust the bot’s settings to ensure optimal performance.

- Limited Customization: (Top 10 Crypto Trading Bots)

Trading bots are designed to follow pre-set algorithms and trading strategies, and customization options may be limited. Therefore, traders may need to adjust their trading strategies or switch to a different bot to achieve their specific goals. It’s essential to research different trading bots and their customization options before choosing one to ensure that it aligns with your trading goals and strategies.

crypto trading bot review (Top 10 Crypto Trading Bots)

While trading bots offer many benefits, they also come with potential risks and drawbacks. To mitigate these risks, traders should keep an eye on technical issues, and market volatility, and stay involved in the trading process. It’s essential to understand that trading bots are tools to help with trading, not a substitute for human decision-making. By researching different trading bots and their customization options, traders can make informed decisions about whether to use them and how to mitigate their risks. choosing the right crypto trading bot depends on your trading experience and specific needs. Whether you’re a novice or an experienced trader, there is a Top 10 Crypto Trading Bots suitable for you.

FAQ – Top 10 Crypto Trading Bots 2023

How much does it cost to use a crypto trading bot?

The cost of using a crypto trading bot varies depending on the provider and features offered. Some bots offer free trials or are free to use, while others charge monthly subscription fees or take a percentage of profits earned.

Can I make money using a crypto trading bot?

Yes, it is possible to make money using a crypto trading bot. However, success is not guaranteed, and profits depend on the bot’s performance and market conditions.

How do I choose the right crypto trading bot for me?

Choosing the right crypto trading bot depends on personal trading preferences and the desired level of automation. It is important to research different bot providers and consider factors such as fees, trading strategies, and customer reviews.

Are there any risks involved with using a crypto trading bot?

Yes, there are risks associated with using a crypto trading bot. The bot’s performance is highly dependent on the quality of data and the accuracy of the algorithms used. Technical malfunctions, cyber-attacks, and sudden market changes can also impact the bot’s performance.